The Importance of Taxation Law Firms in Business

Taxation law firms play a crucial role in the business landscape by assisting organizations in managing their tax obligations effectively. The complexities inherent in tax regulations often leave businesses vulnerable to legal issues or suboptimal tax strategies. This article explores the multifaceted contributions of taxation law firms, their functions, and how they can empower businesses to thrive in a competitive environment.

Understanding Taxation Law

Taxation law encompasses a vast array of regulations governing how various forms of taxes are levied by the government on individuals and businesses. Understanding the fundamentals of taxation law is vital for any business owner as it impacts profitability and compliance. The primary objectives of taxation law include:

- Revenue Generation: Taxes are essential for government funding of public services.

- Wealth Redistribution: Taxation can help reduce economic inequality.

- Regulatory Function: Taxes can be used to regulate and control business practices.

- Economic Stability: Tax policies can influence economic growth and stability.

Why Businesses Need Taxation Law Firms

As businesses grow, so does their tax complexity. Here are several reasons why hiring a taxation law firm is essential:

1. Expert Guidance on Compliance

Tax regulations are often dynamic, changing annually with new policies and interpretations. A qualified taxation law firm provides expert guidance, ensuring your business complies with current laws. Their expertise includes:

- Staying updated on changes in tax legislation.

- Advising on local, national, and international tax compliance.

- Assisting in the proper filing of tax returns.

2. Tax Strategy Development

Effective taxation strategy can lead to significant cost savings. Taxation law firms assist businesses in:

- Identifying deductions and credits that minimize tax liability.

- Planning for long-term tax efficiency.

- Implementing tax-advantaged structures (such as trusts or partnerships).

3. Representation in Disputes

In instances of tax disputes or audits, having a taxation law firm on your side is invaluable. They provide:

- Expert representation in negotiations with tax authorities.

- Defending against audits or assessments.

- Guidance in resolving disputes through settlements or litigation.

Key Services Offered by Taxation Law Firms

Taxation law firms offer a myriad of services that cater to the unique needs of businesses:

1. Tax Planning and Advisory

Planning is essential in helping businesses forecast their tax liabilities efficiently. Taxation law firms offer:

- Business entity selection advice.

- Investment planning to maximize tax benefits.

- Cross-border tax strategy for international businesses.

2. Estate and Trust Taxation

For businesses involved in estate planning, taxation law firms assist by:

- Defining tax implications of estates and trusts.

- Establishing tax-efficient estate plans.

- Managing compliance with tax filings for trusts.

3. Corporate Tax Services

Corporations often face distinct taxation challenges. Taxation law firms offer services such as:

- Mergers and acquisitions tax compliance.

- Employee compensation and benefits taxation.

- Transaction structuring to minimize tax exposure.

Finding the Right Taxation Law Firm

Choosing the right taxation law firm can significantly influence your business's financial health. Here are some tips to consider:

1. Specialization

Ensure that the firm specializes in taxation law. Look for experience with your specific industry, as tax regulations can vary widely.

2. Reputation

Research the firm's reputation through client testimonials, online reviews, and professional recognition within the legal community.

3. Communication

Effective communication is key. Choose a firm that takes the time to explain tax concepts clearly and is responsive to your queries.

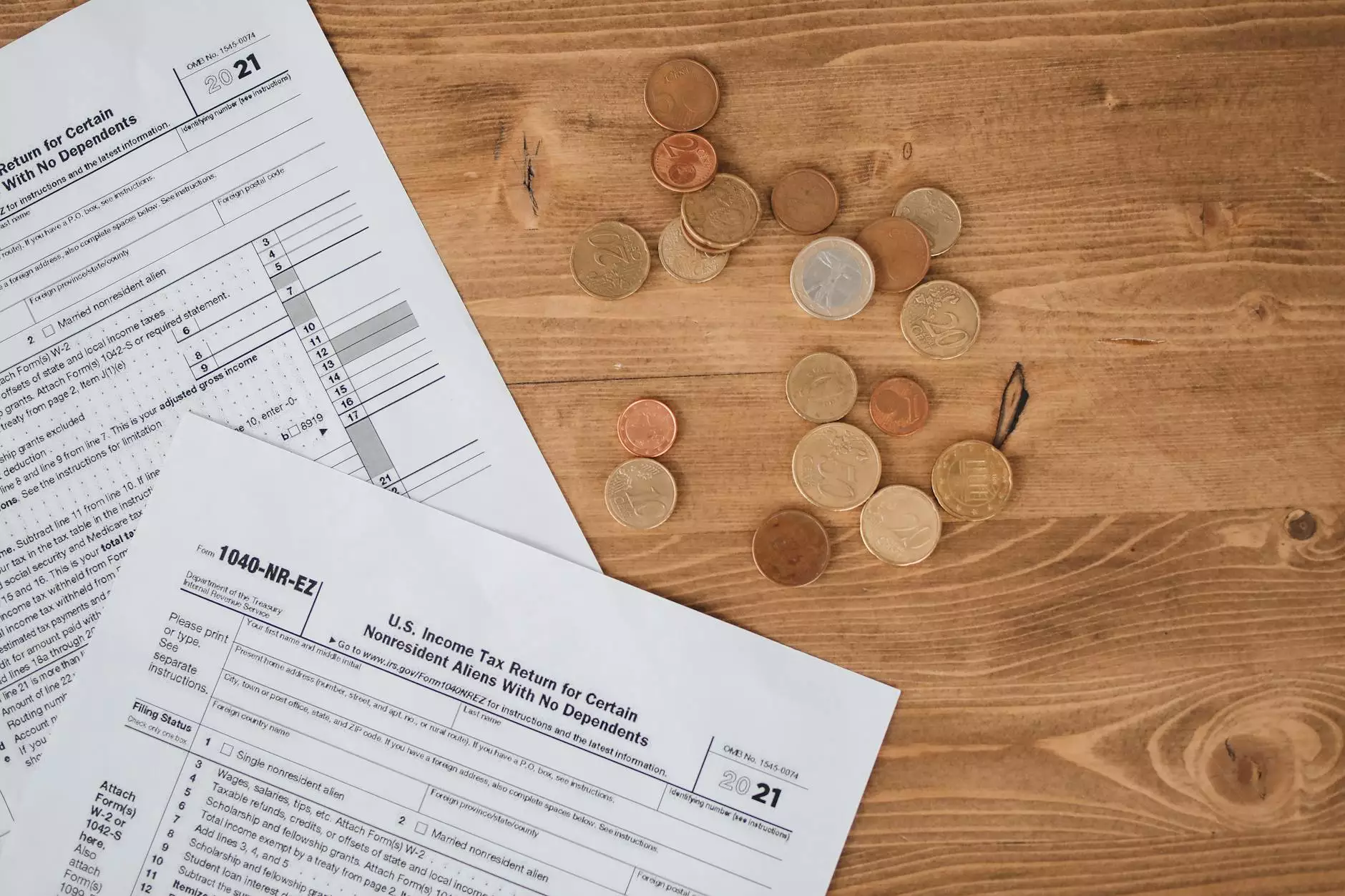

Cost Implications of Taxation Law Services

While hiring a taxation law firm incurs costs, it is essential to view this as an investment. The potential savings from reduced tax liabilities and avoided legal issues far outweigh the advantages. Here’s a breakdown of cost considerations:

- Fees: Understand the fee structure. Some firms charge hourly, while others have fixed fees for specific services.

- Return on Investment: Consider the long-term savings that may arise from optimized tax strategies.

- Value Addition: Assess how a firm can add value beyond mere compliance, such as strategic planning and risk management.

Leveraging Technology in Taxation Law

Many taxation law firms are adopting technology to enhance their services through:

- Tax Software: Advanced software for accurate tax calculations and filing.

- Data Analytics: Using data to identify tax-saving opportunities.

- Client Portals: Secure online access to documents and communication for clients.

Conclusion

In today’s complex business environment, having a reliable taxation law firm is not merely beneficial; it is essential. Their expertise ensures that businesses remain compliant, optimize their tax strategies, and ultimately safeguard their financial wellbeing. By integrating tax planning into broader business strategies, organizations can achieve not only compliance but also competitive advantage.

In summary, businesses that prioritize their tax planning and compliance by engaging taxation law firms are better positioned for success in a dynamic market. Investing in legal expertise is a proactive approach to navigating the labyrinth of taxation laws with confidence.